Money magazine: Consumer Finance Awards 2025, Margin Lender of the Year. The winner was judged by Rainmaker Information to achieve the highest score across core dimensions, spanning product and investment choice breadth, depth, research services, type of investment available, access to international markets and interest rates payable on loan products.

Why margin lending with NAB

What is margin lending?

Margin lending is a gearing solution where an investor borrows funds from a lender to invest in a portfolio of listed securities and/or managed funds.

Managing your loan

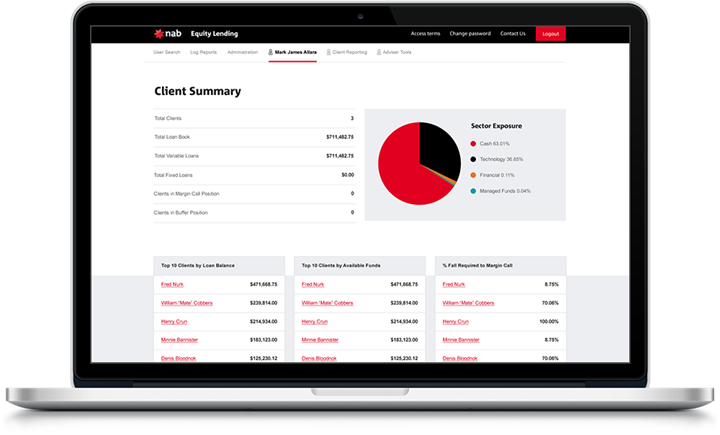

- 24/7 online access - monitor your NAB Equity Lending facility and keep track of your investment online.

- A dedicated Relationship Manager - access to a personal relationship manager who will look after your facility and assist you with any queries.

- Regular facility statements - receive regular statements outlining your facility details.

Margin Lender of the Year

NAB is proud to be awarded Margin Lender of the Year by Money Magazine*.

NAB Margin Lending has been established for 25+ years and remains committed to providing investors innovative gearing solutions for their investing needs.

Read Money Magazine’s article on how they selected this year’s Margin Lender of the Year.

*The winner was judged by Money Magazine/Rainmaker Information to achieve the highest score across core dimensions, spanning product and investment choice breadth, depth, research services, type of investment available, access to international markets and interest rates payable on loan products.

Our products

Every investor has different needs. Discover our diverse range of margin lending products to help diversify your portfolio.

- Growth investor

- International exposure

- Looking for certainty

- SMSF trustee

NAB Margin Loan

The share market presents many opportunities to invest. Some opportunities come with a deadline - IPOs, capital raisings, share purchase plans or rights issues.

For the investor willing to take advantage of as many opportunities as possible, the ability to react in a timely fashion will be controlled by the ease of access to funds.

When an investor’s only source of funds is the sale of existing investments, the decision “to buy” will be compounded by the decision of “what to sell”. The “what to sell” decision can become challenging, particularly if it is done under time pressure.

A margin lending facility, secured by an existing portfolio, can become the source of funds for a broad range of investment opportunities. With a NAB Margin Loan investors enjoy:

- Access to 2,500+ ASX listed securities, exchange traded funds, international listed shares and unlisted managed funds

- Fund withdrawals

- Flexible investment opportunities

While a margin loan can increase gains in a rising market, it can also magnify losses when the market declines. Find out more about the risks and benefits of a NAB Margin Loan.

NAB Margin Loan

Just as a margin loan can enable an investor to respond to local investment opportunities, it can also be an efficient way to gain exposure to international investments.

For nabtrade and JBWere clients, a margin loan through NAB now allows investors to invest in over 1,000 internationally listed companies, depending on the broker. By pledging Australian shares as loan security, borrowed funds can be used to acquire shares in growth sectors globally.

The same margin loan facility can also accept existing international shares as loan security, and the borrowed funds can be used to acquire ASX securities. With a NAB Margin Loan investors enjoy:

- Access to domestic and international opportunities

- Retention of existing assets

While a margin loan can increase gains in a rising market, it can also magnify losses when the market declines. Find out more about the risks and benefits of a NAB Margin Loan.

Please note: Only clients of nabtrade, JBWere (ACN 137 978 360 and AFSL 341162) and Macquarie Bank Limited (ABN 46 008 583 542, and AFSL and Australian Credit Licence 237502) can use international shares as loan security.

NAB Equity Builder

For goal oriented investors looking for certainty.

There are some financial goals that emerge with greater clarity - specifically when the size and timing of the financial target are both known. Such targets might include:

- House deposit

- School fees

- A non-concessional superannuation contribution, or

- Funds to supplement a lifestyle change – prior to authorised access to any accumulated superannuation funds.

In the past, a margin loan may have been used for such a purpose, but if gearing levels are not managed carefully, an investor’s accumulated equity may be negatively impacted.

NAB Equity Builder can become a more stable place to accumulate equity, due to its no margin call structure, and the discipline of the regular principal repayment process. Equity is accumulated via additional contributions, progressively reducing both the gearing level, and the potential impact of negative market events closer to the target date.

There are risks associated with this product including falling prices, rising interest rates and falling returns. Find out more about the risks and benefits of a NAB Equity Builder.

NAB Super Lever

Have the desire to use leverage to grow your SMSF assets?

The ATO guidelines provided to all SMSF trustees places an expectation on fund trustees that they will balance diversification with the process of maximising returns for the fund.

For funds over $1m, the borrowing capacity exists to build a portfolio of Limited Recourse Borrowing Arrangements (LRBAs). This means that a degree of diversification can be created, even though each loan arrangement is restricted to acquiring a single asset.

The maximum concessional contribution for each fund member is capped, and for some SMSFs, annual member contributions can seem to be a very slow mechanism to grow the value of the fund. The underlying performance of the fund starts to become the dominant driver of fund growth.

The use of borrowed funds, for SMSFs with the relevant trust deed powers, can be another mechanism where an SMSF trustee can impact the gross value of assets operating within their superannuation fund.

With NAB Super Lever, SMSF trustees can:

- Borrow to invest into their SMSF

- Start with a small initial investment

- Interest payments may be tax deductible

While a margin loan can increase gains in a rising market, it can also magnify losses when the market declines. Find out more about the risks and benefits of a NAB Super Lever.

HELP AND SUPPORT

Contact us

Call

1300 135 145

(from outside Australia:

+61 3 8903 9912)

Monday - Friday

8.30am - 5.00pm (AEST/AEDT)

equity.lending@nab.com.au

nabtrade enquiries

For all nabtrade enquiries, please call nabtrade on 13 13 80 or visit www.nabtrade.com.au

Interpreters available

Do you have limited English or prefer to speak in a language other than English? When you call us, just say “I need an interpreter” and we’ll arrange for someone to help with your enquiry.

National Relay Service

If you’re d/Deaf or find it hard to hear or speak to hearing people on the phone, the National Relay Service can help. To contact NAB give our phone number 1300 135 145 to the National Relay Service operator when asked.